QuickBooks can assist with tasks from bookkeeping and payroll to inventory analysis and profitability. Contact us today to discover what QuickBooks can do to help you with all of your small business accounting needs. Let’s say you’re trying to determine how many units of your widget you need to produce and sell to break even.

How do you calculate the break-even point?

Calculating the break-even point in sales dollars will tell you how much revenue you need to generate before your business breaks even. This point is also known as the minimum point of production when total costs are recovered. business accounting systems In accounting, the margin of safety is the difference between actual sales and break-even sales. Managers utilize the margin of safety to know how much sales can decrease before the company or project becomes unprofitable.

Break Even Revenue Calculator

If a company has reached its break-even point, the company is operating at neither a net loss nor a net gain (i.e. “broken even”). To learn more about stocks and how to begin investing, check out The Motley Fool’s Broker Center. Knowing the break-even interest rate is important in comparing bonds. With it, you can make your own predictions about what the future will bring and make a decision accordingly. Some stocks are rather immune to inflationary pressure, while others can even benefit from inflation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Situation 1: Comparing short-maturity bonds with long-maturity bonds

Often times you will find the need to adjust your costs and factor in things you overlooked before. Depending on your needs, you may need to calculate your profit margin or markup to find your revenue… This will allow you to calculate the maximum price you may pay for goods, given all of your other numbers.

Get Started with Our Break-Even Point Calculator

- In this breakeven point example, the company must generate $2.7 million in revenue to cover its fixed and variable costs.

- Break-even analysis works well for short-term planning, like setting immediate sales goals or dedication to prices.

- There is no net loss or gain at the break-even point (BEP), but the company is now operating at a profit from that point onward.

- For instance, if your restaurant is introducing a new signature dish, you’ll want to know how many orders of that dish you need to sell to cover the costs of ingredients, staff time, and marketing.

Once you’ve determined your break-even point, you’ll be able easily view how many products you need to sell and how much you’ll need to sell them for in order to be profitable. If you won’t be able to reach the break-even point based on the current price, it may be an indicator that you need to increase it. This is beneficial for businesses that have been selling the same product at the same price point for years or businesses that are just beginning and are unsure of how to price their product. The break-even point is the volume of activity at which a company’s total revenue equals the sum of all variable and fixed costs.

Which of these is most important for your financial advisor to have?

A breakeven point calculation is often done by also including the costs of any fees, commissions, taxes, and in some cases, the effects of inflation. Assume an investor pays a $4 premium for a Meta (formerly Facebook) put option with a $180 strike price. That allows the put buyer to sell 100 shares of Meta stock (META) at $180 per share until the option’s expiration date. The put position’s breakeven price is $180 minus the $4 premium, or $176. If the stock is trading above that price, then the benefit of the option has not exceeded its cost. You might want to add new products to sell to reach the break even point.

Knowing this allows you to set targets for your sales teams and provide incentives for them (financial, promotion, shares etc.). The key overall factor is the visibility that the figures provide. Quantifying the success rates allows those with drive and determination to push to achieve the highest levels which is great for personal achievement, financial reward and overall business success.

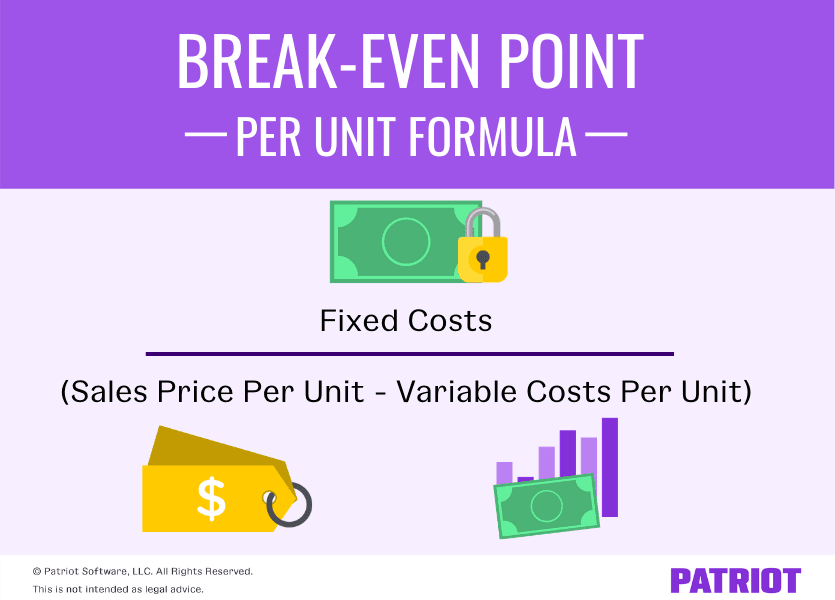

With the contribution margin calculation, a business can determine the break-even point and where it can begin earning a profit. To find the total units required to break even, divide the total fixed costs by the unit contribution margin. Break-even analysis involves a calculation of the break-even point (BEP).

External circumstances, like trade agreements and changes in the political climate, have an impact on your sales. In such cases, break-even analysis will help you to decide on new prices for your products. The break-even point gives you a clear picture of how much time will it take for your business to recover any losses and break even again after a change in the business forecast. In this case, you estimate how many units you need to sell, before you can start having actual profit.

You can also check out our markup calculator and margin calculator. When analyzing your break-even point, not only do you want to see that your business is breaking even, you’re looking to make sure your business is profitable as well. Here are a few ways to lower your break-even point and increase your profit margin. Once you’ve decided whether you want to find your break-even point in sales dollars or units, you can then begin your analysis.